February 21, 2025

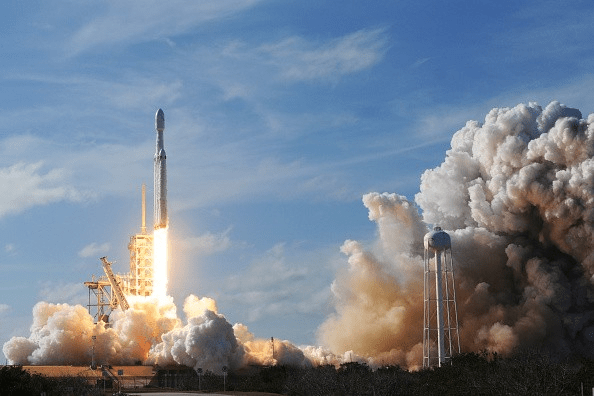

Greetings, cosmic travelers and starry-eyed investors! Here at From Earth to Space, we’re always on the lookout for the next big thing in the cosmos—and right now, the space stock arena is buzzing with electric potential. Leading the charge is AST SpaceMobile (NASDAQ: ASTS), a trailblazer aiming to beam cellular broadband straight from orbit to your smartphone. But what’s on the horizon for ASTS and its fellow spacefaring peers? Buckle up as we dive into the upcoming results, catalysts, and wild possibilities that could send these stocks rocketing—or leave them drifting in zero gravity.

AST SpaceMobile: Connecting the Globe from Orbit

AST SpaceMobile dreams of a world where your phone works anywhere, powered by a constellation of orbiting satellites. After launching five Block 1 Bluebird satellites in September 2024, they’ve proven their tech can talk to AT&T and Verizon networks from low Earth orbit (LEO). Now, it’s about scaling up. Their Q4 2024 earnings, due March 31, 2025, are expected to show a $0.19 per-share loss and $2.38 million in revenue—small potatoes for a pre-revenue giant. Investors will zero in on beta test results and whether those juicy prepayments ($20M from AT&T, $25M from Vodafone, $65M from Verizon) are unlocking. Any hint of operational satellites or cash flow could spark a rally after 2024’s 344% surge.

The big catalyst? The Q1 2025 launch of 17 Block 2 Bluebirds—massive, 2,400-square-foot beasts with 10x the capacity of Block 1, promising speeds up to 120 Mbps. A successful deployment could push AST toward commercial service, though delays or technical hiccups might stall the hype. Regulatory wins, like broader FCC approval for Supplemental Coverage from Space (SCS), are also crucial. With 45 mobile network partners covering 2.8 billion subscribers, new deals—say, deeper Google integration or government contracts—could be galactic. But watch out: R&D costs are climbing, and a $400M ATM offering lingers as a potential dilutive shadow.

Rocket Lab: Rockets, Reusability, and Relentless Growth

Rocket Lab has become a small-sat launch kingpin, with its Electron rocket flying 16 times in 2024 and driving a 360% stock surge. Their Q4 2024 earnings, expected late February or early March 2025, follow a Q3 where sales leapt 50% to $105M—and they’ve teased doubling that in Q4. The focus will be on their $515M backlog and new contracts, especially with NASA or commercial heavyweights. A beat here could keep the rocket engines roaring.

The Neutron rocket is the game-changer to watch. Slated for a 2025 test flight, this reusable, medium-lift monster targets bigger payloads—and bigger clients—than Electron. If it flies successfully, Rocket Lab could steal market share from pricier competitors. They’re also expanding manufacturing in California and New Zealand, aiming to churn out 20+ launches annually. A pro-space Trump administration might juice government demand, but supply chain snags or a failed test could ground momentum. After December 2024’s 41% weekly spike, this stock’s volatility is as wild as its potential.

Intuitive Machines: Lunar Ambitions Take Root

Intuitive Machines made history in 2024, landing America’s first private lunar craft and soaring 274% in the process. Their Q4 2024 earnings, due March 2025, project a $0.12 per-share loss with $50.89 million in revenue. Investors crave updates on NASA’s Artemis program ties and a $117M lunar payload contract from last year. A strong backlog or mission timeline clarity could fuel another lunar leap.

The IM-2 mission, targeting mid-2025, is the next big catalyst. Delivering more payloads to the Moon could solidify Intuitive’s role in Artemis—and beyond. Rumors swirl of a VIPER rover bid or new NASA deals, especially with privatization whispers under Jared Isaacman’s potential NASA reign. At a $400M market cap, it’s a small fish in a big pond—volatility’s guaranteed, but a successful landing might catapult it to the stars.

Spire Global: Turning Space into Data Gold

Spire Global quietly tracks weather, aviation, and maritime patterns from orbit, shedding its maritime unit for $241M in Q1 2025. Their Q4 2024 earnings, expected early March, won’t show profits (that’s 2027’s goal), but revenue growth from their 100+ satellite fleet will be key. With debt cleared and cash to burn, Spire’s pivoting to AI-driven insights—think hyper-accurate forecasts or ship tracking.

Catalysts include new contracts—government or commercial—leveraging that sale windfall. A leaner Spire could surprise with profitability hints, especially if weather data demand spikes in a climate-conscious 2025. After a 20% late-2024 rally, it’s a sleeper stock with upside if execution clicks. Overreach or slow growth, though, could leave it adrift.

Planet Labs: Imaging Earth’s Every Move

Planet Labs nearly doubled in 2024, its 200+ imaging satellites snapping daily Earth pics. Q3 fiscal 2025 earnings (early March) target $62M in revenue, with losses narrowing. The push toward profitability by early 2026 is the headline—any acceleration could thrill investors. Their data’s a goldmine for agriculture, defense, and climate monitoring.

New government contracts—like 2024’s U.S. Forest Service deal—or AI-enhanced offerings could drive 2025 gains. With a $500M market cap, Planet’s got room to grow, but competition from BlackSky and Maxar looms. A strong Q3 and clear roadmap might keep this orbit steady—stumbles could ground it.

BlackSky: Eyes in the Sky, Intel on Demand

BlackSky’s geospatial intel, powered by 14 satellites, saw 91% revenue growth in 2024’s Q3. Q4 earnings (early March) will spotlight contract execution—think $50M from the U.S. Army or Indo-Pacific deals. At a $220M market cap, it’s a scrappy contender with big ambitions.

Expanding its constellation or snagging more defense wins in 2025 could propel BlackSky upward. Real-time imaging demand is surging, and a Trump-led defense push might help. But execution risks and cash burn linger—success hinges on delivering for clients like the NGA. This one’s a high-wire act with serious upside.

Redwire: Crafting the Cosmic Future

Redwire’s lunar tech and bioprinting feats drove a 400%+ 2024 surge. Q4 earnings (March) will unpack a $280M backlog, boosted by a $12.9M NASA lunar road deal. Revenue’s climbing, but profitability’s distant—investors want mission updates and cash flow hints.

Catalysts include Very Low Earth Orbit (VLEO) satellite progress and more Artemis contracts. Redwire’s niche—building in space—could shine if NASA privatizes further. At $600M market cap, it’s volatile but visionary. A strong Q4 or new deal could send it lunar—delays might stall the hype.

Sector Catalysts

The incoming Trump administration’s pick of Jared Isaacman (Shift4 Payments CEO and Musk ally) to lead NASA is stirring the pot. If Isaacman pushes privatization—think more SpaceX-style partnerships—the rising tide could lift all space boats. Add in SpaceX’s Starlink expansion (a rival to ASTS, but a sector validator) and Blue Origin’s New Glenn rocket (set to carry AST’s satellites in 2025-2026), and the space race feels red-hot.

From Earth to Space: What’s the Play?

For AST SpaceMobile, the next few months are a proving ground. A strong Q4 update and Block 2 launch could cement its status as a space stock supernova, though competition from Starlink and funding hurdles loom large. Rocket Lab’s Neutron, Intuitive’s lunar bets, Spire’s data pivot, Planet’s imaging edge, BlackSky’s intel, and Redwire’s innovation all offer unique thrills. For the broader sector, 2025 feels like a breakout year—private innovation, government support, and a thirst for cosmic connectivity are aligning. Which ship will you board? The cosmos awaits!

Leave a comment